Blanco KYC & Compliance Suite for investment funds

Why our solution fits your business so well.

If you run a Venture Capitalist or Private Equity fund, you can’t escape from having to comply with the European Anti-Money Laundering/Counter-Terrorism Financing (AML/CTF) legislation. You are required to prove that you‘know your investors well’ (Know Your Customer – KYC) and that your investors do not represent a money laundering or terrorist risk. A lot of hassle, but with Blanco’s KYC & Compliance Suite it’s guaranteed to get a lot easier.

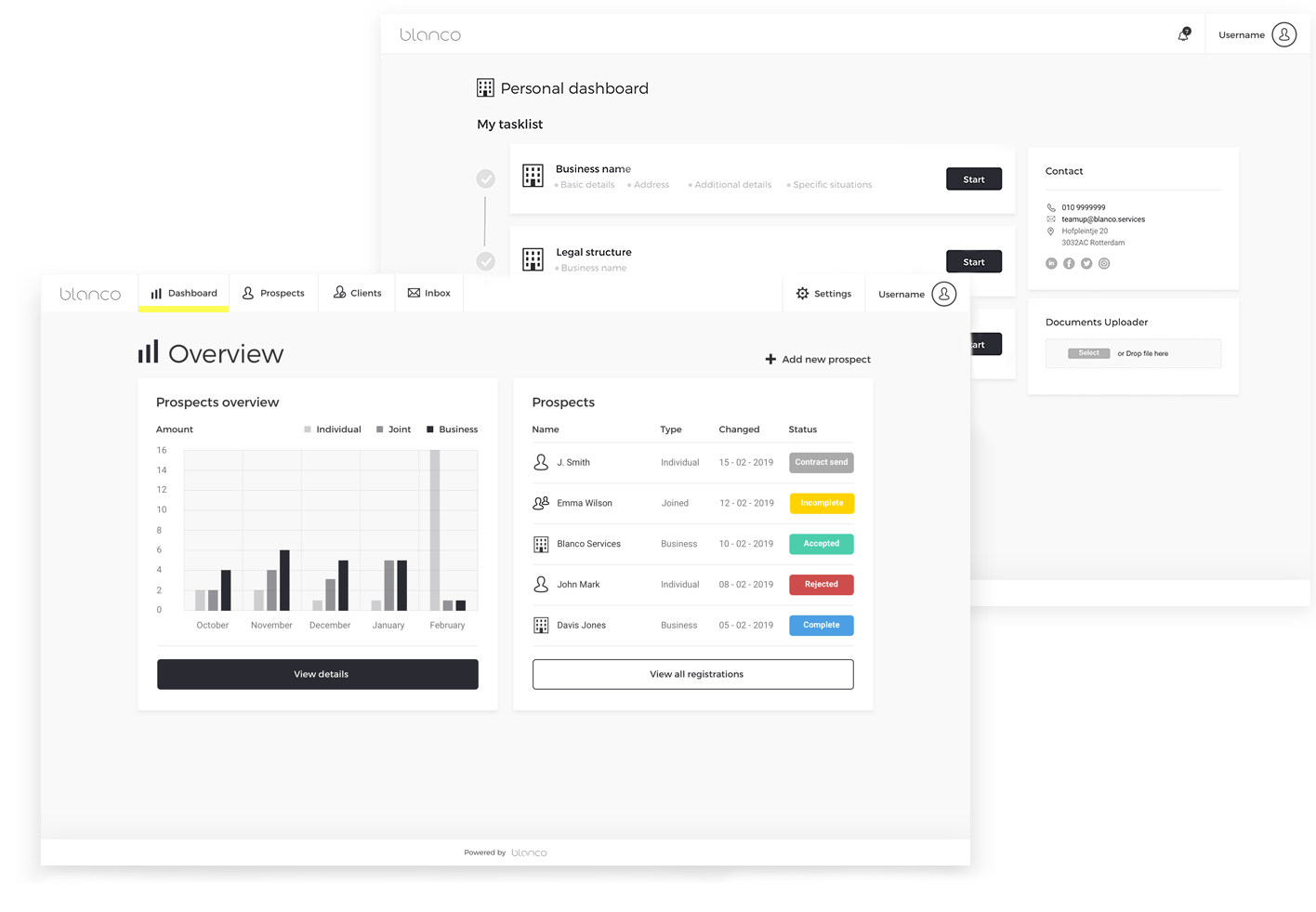

Blanco is originally a one-stop-shop for wealth- and asset managers: we offer a complete online administration platform for independent wealth- and asset managers, including a user-friendly KYC & Compliance Suite in which client data is retrieved, checked and documented. In essence, a wealth- or asset manager is not very different from your fund: you’re also investing in assets on behalf of a manageable group of investors. That’s why our solution seamlessly fits with your VC or Private Equity fund. Plus, we’re working hard on tailoring our complimentary fund administration module for investment funds. With Blanco you’re already gearing up for a one-stop-shop solution for your entire fund administration.

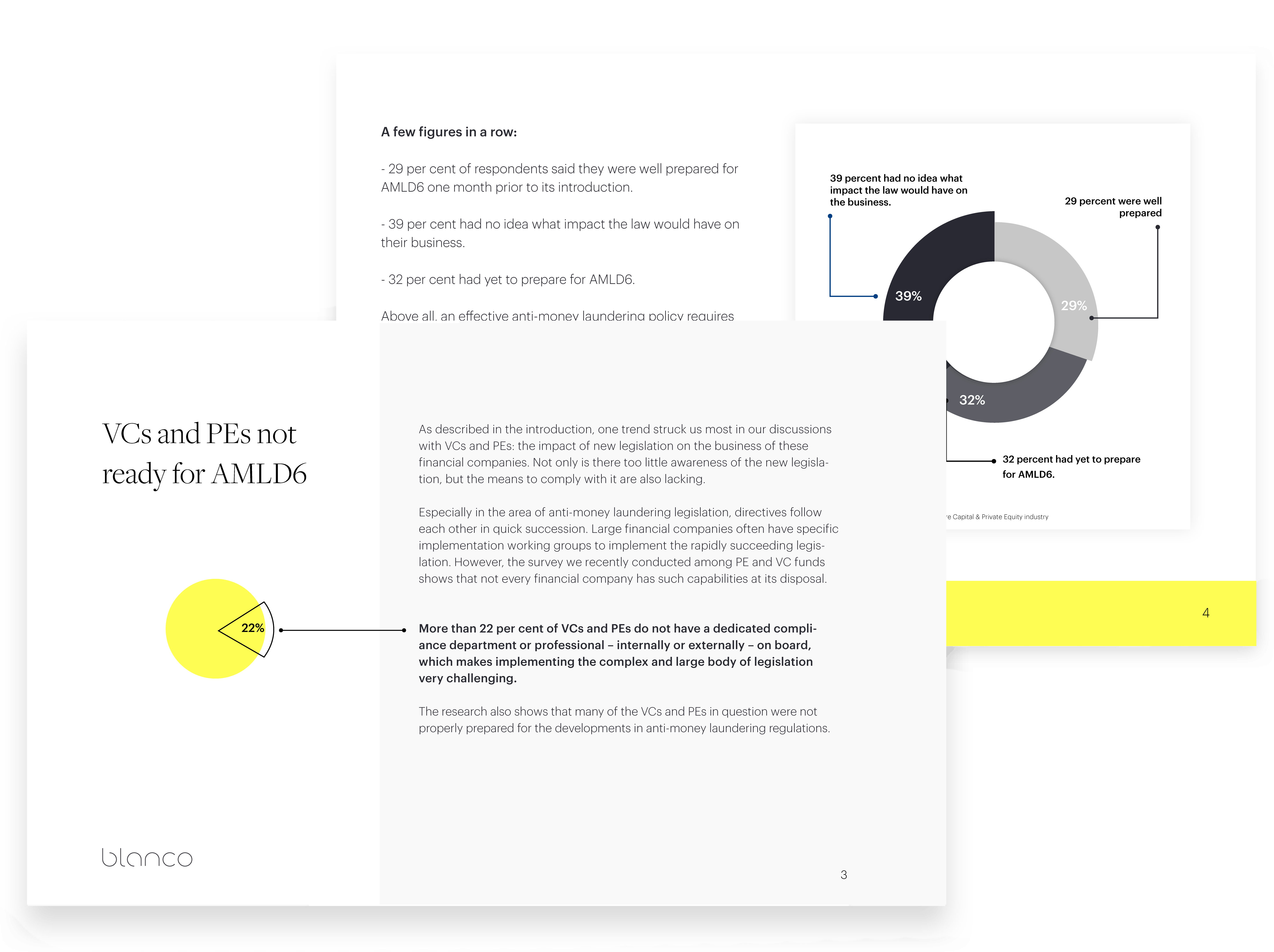

Discover the challenges of Venture Capital and Private Equity firms in Europe

Client Onboarding

- Suitable for all natural persons and legal entities.

- Easily add customised client surveys and questionnaires.

- Identify your investors with the help of a passport scan, liveness check and derived identification.

- Screen your investors using the Adverse Media Check, Politically Exposed Person (PEP) List and comprehensive global sanctions lists for persons associated with economic crimes or terrorism.

- Conveniently generate and sign documents digitally using SMS, iDEAL, iDIN, ITSME or E‑Identity.

- Suitable for automatically reassessing and actualising all your investors’ data, if required by the supervisory authority.

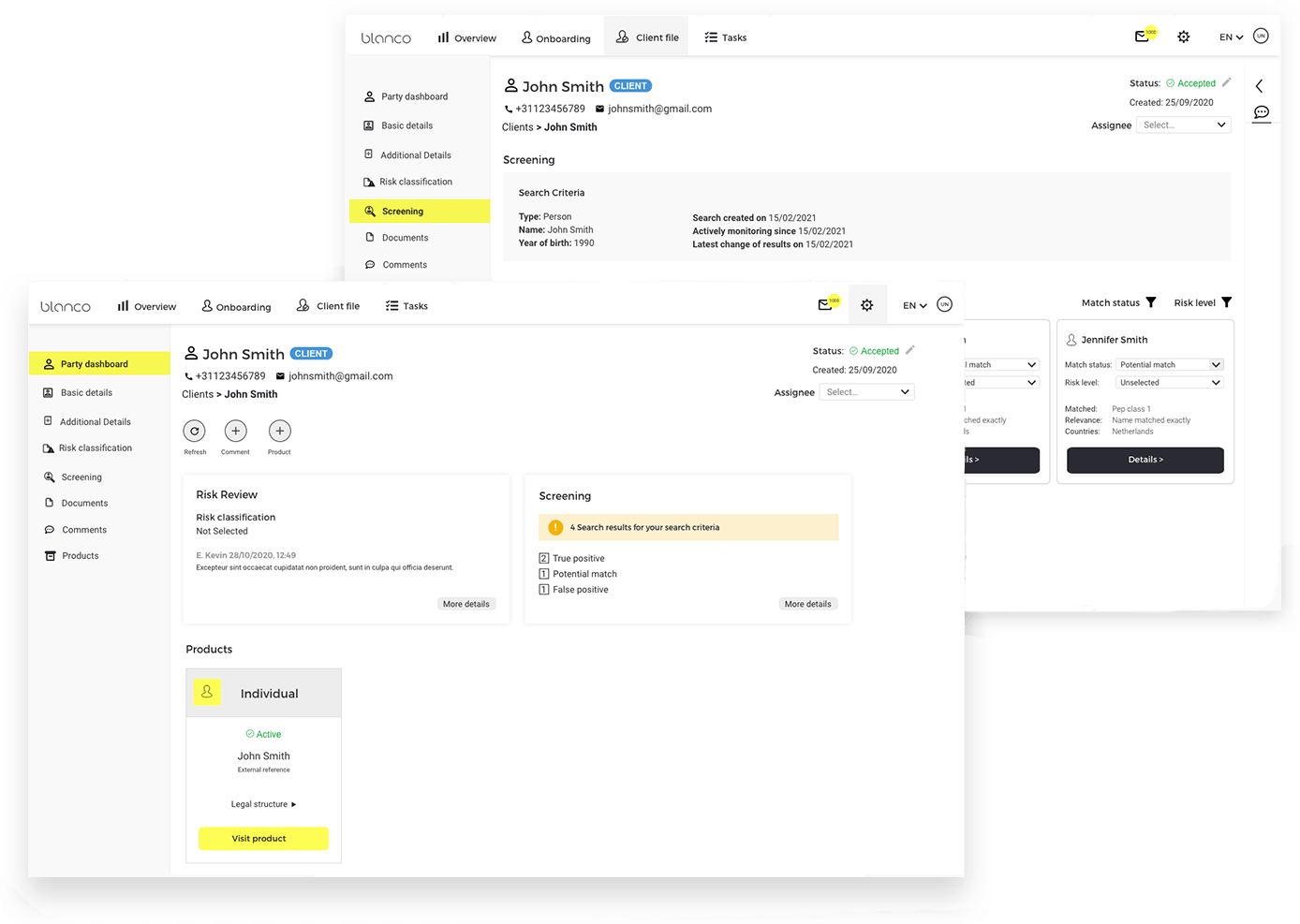

Client File

- Monitor your investors using the Adverse Media Check, Politically Exposed Person (PEP) List and comprehensive global sanctions lists for persons associated with economic crimes or terrorism.

- Suitable for automatically reviewing and actualising all your investors’ data, if required by the supervisory authority.

- Monitor your investors risk profile on continuous basis.

- Suitable for all natural persons and legal entities.

- Easily add customised customer surveys and questionnaires.

- Conveniently generate and sign documents digitally using SMS, iDEAL, iDIN, ITSME or E‑Identity.

Fund administration

- Use the CRM module to manage your tasks and record all relevant prospect and client information (personal details, conversations, digital documents, events, scenario analyses, etc.).

- Fully adaptable to your way of working, e.g. fund reporting, management of your own portfolios, client contact, administration of investment requests, etc.

- Invoice your clients using multiple calculation definitions.

- Use the reporting function to keep clients informed of the performance of their portfolio and to report to the regulator.

- Create your own white-labelled online portal for your investors, where they can monitor their investments, contact you and have access to their own digital safe.